The graying of the American workforce continues: Baby boomers are working longer and earning more than their predecessors did in what Americans typically think of as retirement years, new research finds.

Almost 20% of Americans ages 65 and older were employed this year, according to a new report from Pew Research Center. That’s nearly double the share of those who were working 35 years ago. In total, there are around 11 million Americans 65 or older who are working today, comprising 7% of all wages and salaries paid by U.S. employers. In 1987, they made up 2%.

And not only are more Americans at or above the traditional retirement age of 65 working, but they are also earning substantially more compared with what older workers earned in the 1980s. Now, the typical older worker earns $22 per hour, compared with $13 per hour then. Their wage growth—some of which can be attributed to their working longer hours than older Americans did in the past—has outpaced that of workers ages 25 to 64 over the same time period, according to Pew’s research, which is based on data from the U.S. Census Bureau’s Current Population Survey and the Federal Reserve’s 2022 Survey of Household Economics and Decisionmaking.

$13 in 1990 is 35$ today with inflation. They are working more for 50% less.

Surely they adjusted for that.

I dk depends if there is an agenda or if the person saw data and forgot. I’m always skeptical if they don’t say equalivent or with inflation. They just wrote “compared” which seems like no math was done. Pretty sure we are all earning less than our counter parts in 80’s.

Shirley.

And don’t call me Shirley.

RIP Leslie Neilsen.

I’m not even sure where they got it from because it’s not in the linked Pew article… from 4 years ago.

What a useless article. It doesn’t even account for inflation. Is it designed to make boomers feel good about having to be a wal-mart greeter to survive?

Perhaps they are “bored” in retirement because even after a lifetime of labor there isn’t enough money left to do anything but sit and watch tv?

I’ve lost count of how many boomers I’ve heard say “I don’t know what I would do with myself if I didn’t have to work”. Fuck that generation. They had a chance for everything and said “whatever!” And just did nothing instead.

Literally heard a group of boomers talking over coffee the other day. One goes " weird we haven’t had snow, I guess it could be because of global warming" then another goes “yeah but not like we need to care!” Then they all had a big laugh about it…

Hey, when You’re part of the hip / cool club😎 👍 You can totally do that

/s

Thx for the downvotes. Always welcome 🤗 / appreciated

More like the “oww my hip!” Club 🤣

😂 true tho

They’re the same flavor fucked as us. I don’t hate them for not knowing what to do with themselves without working. I hate the meat grinder we’re in

First, their ‘i love work’ attitude is both taught from society (look at this article for example) and straight up cope. Not just that; their lives like our lives have been consumed by work and the business of living. I too have had precious little time and energy to spare on developing ourselves outside it.

In a country like US there should never be a shortage of jobs. And all jobs should pay a living. Also provide many opportunities to climb the ladder. There should not be a shortage on American Dream basically.

A fluff piece telling me how I should feel grateful for working till I die because it will appear that I’ll make more money?

The fun one is where they brag that older workers are making “substantially more” because they’re averaging $22/hr versus $13/hr in 1987. Adjusted for inflation, that $13/hr should be around $35/hr.

More people are working longer for less money.

Okay thank you, I was so confused reading that. I was waiting for any mention of adjusting for inflation.

I think this article is making an incorrect assumption that these older workers are sticking around in the same caliber jobs they had when they were younger. Those people simply enjoy their jobs, and can still do them, so are not ready to just stop doing it. But there are many more classes of older workers:

-

the ones with the financial security to retire early, but do not want to just sit around the house all day. They may want to stay employed part-time somewhere as a social outlet.

-

the ones with the financial security to retire early, except for health care. These workers might take jobs with less responsibility and pay, but make liberal use of their health insurance until they qualify for Medicare.

-

the ones who don’t have that financial security, so they still need to be an active part of the workforce until their Social Security payments kick in.(which still may not be enough)

So, it’s not always the case that an older worker remaining in the workforce prevents another mid-life worker from advancing. However, every older worker remaining in the workforce fills someone else’s position, and eventually it all trickles down to the entry level jobs. So it does end up screwing today’s new grads in the end, just like their student loan debt and the sky-high housing prices do.

My manager is a prime example of your first category. He has a nice federal retirement and a chunk of a 401k, but he stays here…riding his desk. He can’t begin to fill the shoes of the Gen-X manager he replaced. Thus the quality of my department suffers because he’s a weak manager and susceptible to the schmooze by younger employees.

He took over the position just after he: 1. Moved 2 hours away, and 2. Had a massive heart attack. This guy’s circumstances are screaming at him to retire, but he just. Won’t. Move. On.

Those people simply enjoy their jobs

Or maybe they just can’t afford to retire

However, every older worker remaining in the workforce fills someone else’s position, and eventually it all trickles down to the entry level jobs.

Assuming anyone is hiring entry-level positions.

At my company, there have been countless rounds of layoffs and early retirement packages, and nobody being hired at entry-level. The few people who have been hired have come in with a decade or more of industry specific experience, and have been expected to hit the ground running.

I don’t know if all industries are following similar trends, but my kids experience trying to find “no experience needed, entry level” jobs suggests it is pretty wide spread.

Working your way up from the bottom seems to be increasingly a thing of the past.

-

The interesting thing is when you think about how social security is supposed to work.

The younger generations need to work and earn a decent wage to subsidize the older generations retirement.

The longer the older generations stay in the work force, the less openings there are for the younger generations to contribute to social security.

Wait until AI takes jobs -_-

The younger generations need to work and earn a decent wage to subsidize the older generations retirement

That’s not how RRSP works.

No, but it’s still correct.

Retired individuals make use of tax funded systems all the time and those only work if younger people pay taxes.

No that is not correct. That also isn’t how taxes work. Everyone who is working pays taxes and everyone benefits off the taxes they pay into. They don’t pay each other’s taxes.

Retirement is very different from taxes that are paid into for disability or welfare. And if you are not working you are not paying taxes. You’re either pulling from retirement that you pay yourself, unemployment that you also pay yourself or welfare which is a different topic altogether as we’re assuming this is to do with workforce tax so the individual is working and thus paying a tax for later benefit.

If you are talking about RRSP (or RIF dependant on age)that is paid privately from the individual. If you’re referring to a social system such as CPP is still paid into as taxes by the individual.

https://www.canada.ca/en/services/benefits/publicpensions/cpp/cpp-benefit/amount.html

You are still the same person benefitting off your own paid taxes regardless of age. Older people were paying taxes the whole time they worked which they are benefiting on the taxes that they made. Young people don’t donate to it for them. It is written on every pay-cheque you receive.

The issue is that you have to donate it to yourself but if you are not qualified in your job (and if there aren’t enough people to take the supporting roles) the taxes you pay into will be higher but the pay rate will be lower. This is the issue as these roles come up for grabs or that roles get rewritten as the person before them retired. Old people didn’t do this to you. So if you’re looking to blame someone for that, look to the bad managers. Not old Merryl who’s been a working nurse paying her taxes all her life.

you will be old one day and looking to benefit off the taxes YOU paid into all yours life. This isn’t something young people are paying into for someone else. They are paying it for themselves as an assurance and assumption as they get older.

The main complaint about aging population isn’t that someone isn’t paying taxes for an old person, it is that old people are now old enough to retire and leaving work to benefit on the taxes they made all their life and no one is qualified enough to take over the job. And no doubt some shifty bullshit is happening by upper mismanagement to the role the moment they leave. And thus the replacement is a smaller pool that now has to pay more taxes for themselves to benefit.

this isn’t the fault of older people that there was no one ready to replace them. It also isn’t the fault of older people that there are higher tax rates as the population shifts and it’s not equal. They can’t simply change your circumstance by simultaneously existing and not existing and if you think that’s how all your problems are solved, you probably have a lot of problems that are a ‘you being unreasonable about problems’ problem. Not a ‘them’ problem.

Every year, the government funds itself with taxes being paid now. Not years previously. If older people who are retired use the hospital, the hospital’s resources were paid for by the most recent taxes.

And when I pay my taxes now, the government doesn’t take a small percentage of it, put it aside, and mark it as “for road maintenance in X decades”.

If working people stopped paying taxes, all programs would collapse entirely, they wouldn’t keep working only for retired people who paid into them sufficiently.

It’s pretty obvious that all of government needs tax payers every year

seeing as you’re wanting to change the subject to social tax: you’re not actually paying for just the elderly to use the hospital. You’re paying for the whole population as a whole insured and uninsured including yourself whom are the bulk mis-users for emergency health care.

And out of all its cancer taking up a large of the use because of radiation requirements per day which requires a safe parameter away from residential. The moment they can fit a radiation or essentially any day applications offsite requiring a tech away from hospital use the statistics would be greatly affected. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5708862/

And aside from needed services such as that, then you have the plethora of the people whom you are paying for are people misusing services for varying reasons. heck, even misusing 911 which is a tip of the iceberg of people who mis use public services.

And since 2017 and the onslaught of Covid, the greatest misusers are the unmasked and the Covid deniers are whom is wasting your tax dollars and wasting away the medical system with burnout. These are not the elderly nor are they the vulnerable. These are the younger assholes in age brackets having Covid parties. That’s who you should be mad at. Not the palliative patient that lasted all but 4 days to die in a bed (that isn’t even necessarily in a hospital nor is it necessarily not covered privately btw)

Kind of. But working longer also means that person costs less in social security, and the plan was designed as a pyramid scheme. But we can’t grow in population forever. So if this is the glut of old people, they need to work longer. That’s why one of the “fixes” to any system like that is increasing the retirement age. Also the economy isn’t a zero sum problem where I can take your job, really. It’s more like a living system. Jobs get created and lost, it grows from the bottom up.

That’s a good point.

Somethings I didn’t realize I don’t know of till now. When does one withdraw money from social security? Like do they have to request it from the government? A government worker might have a retirement age but for most Americans, it’s more of a guide. I know plenty of people that are in their 70s and they never plan to retire. If they continue to get paid on w-2 and report earnings to the IRS, does that mean they are ineligible to receive social security benefits?

I suppose if they are not able to collect social security money, and they continue to pay into it but they retire later then you are 100% correct and it’s not as big of a problem for the younger generations as I thought.

Although I would say that the job market is in fact a competition. No matter if you are someone with seniority and experience, someone with little experience willing to work for less, or simply an automaton.

subsidize old folks retirement? why? didnt they work for 40+ years? shouldnt that have been long enough to save up a retirement fund?

Why doesnt anyone want to work?

Says the tech illiterate boomer who is vastly underqualified and incompetent compared to the far more qualified and educated millennials who cannot find a job that he makes fun of on facebook all day at work.

I don’t get it…

Sure. The lucky ones amongst those who can’t afford to retire.

Then there’s the unlucky ones.

The headline makes it sound like boomers are out-earning other generations or making good money.

- The average private sector wage is $34/hr. This indicates wildly skewed upper bounds so we can’t draw any conclusions about their earning.

- The median in 2020 was $23/hr, implying boomers are earning less than other generations

- $22/hr is about $45k/yr. Generously that’s about $40k after taxes. Assuming a health plan of $600/mo (premiums are higher at higher ages) and giving a generous 50% employer payment, we’re down to about 37k. tbh I feel like healthcare costs should be doubled or tripled based on costs I’ve seen from family and friends. Rounding nicely, that’s about 2k a month. If we use the incredibly outdated figure of rent/mortgage being 30%, we have 1400 to spend or save. Let’s pretend we’re able to get all bills under 400 so we have 1000 left over to use.

- Hip replacement is conservatively 3k with insurance. That’s three months of work. You’re probably taking FMLA which means you probably need another three months to cover expenses while recovering. Use hip replacement as a stand in for other surgeries.

- Let’s pretend crowns are as cheap as 1k/tooth. You’re probably looking at one a year ish over time.

- Let’s pretend hearing aids are 2.5k and you’re lucky enough to have insurance that covers them every few years. You’re still out of pocket at least 1k, burning another month.

- Some conservative estimates for cancer are about 6k for lung, breast, and rectal after insurance (prostrate is cheaper!). That’s six months assuming no FMLA; you’re probably taking some time so that’s probably more months.

Boomers are fucked earning that. Millenials are even more fucked. Who knows how fucked GenZ is.

Let’s pretend hearing aids are 2.5k and you’re lucky enough to have insurance that covers them every few years. You’re still out of pocket at least 1k, burning another month.

My hearing aids were $3,600 and they were the lower end of the scale. And my insurance didn’t cover a single penny of it.

Boomers are fucked earning that. Millenials are even more fucked. Who knows how fucked GenZ is.

And GenX is ignored again!

Sorry. As a GenX-er, I felt compelled to point that out. Don’t be surprised if future articles talk about how GenX isn’t retiring, but is continuing to work, though. Personally, I’m doing fine for now, but my retirement savings are way too low. I could either save more for retirement and end up financially underwater right now, or keep my head above water and then struggle when it comes time to retire.

So I’ll likely be working until I’m 80 in the hopes of stretching my meager retirement savings through the rest of my life. And that’s assuming that Social Security isn’t gone by then.

Fair callout! I shouldn’t keep forgetting GenX.

In researching all the bullets I was really surprised to find that hearing aids aren’t covered. It’s something like five states have some level of requirement. As someone with hearing loss, that’s really concerning and I’m not looking forward to that.

I shouldn’t keep forgetting GenX.

We’re used to it…

And continuing their destruction of opportunity for future generations.

If I couldn’t afford to stop working, I would be forced to stay on the payroll forever, regardless of what I might prefer to be doing.

“You should have saved more.”

“You lived too extravegently”

“You should have done more politically to prevent the current economic situation from fomenting”

2 of those 3 are often used to dismiss other generations as they struggle.

3rd is just aimed at the generation that made today’s reality happen.

And thinking that the discovery of the cognitive decline would make the policymakers rethink the role of the elder in (or rather out and properly compensated) the workforce… Such a fool I was

I’ve been seeing this headline for at least 10 years now

compared with what older workers earned in the 1980s. Now, the typical older worker earns $22 per hour, compared with $13 per hour then

$13 in 01/1980 is $51 in 11/2023 based on buying power. $13 in 01/1989 is just shy of $33 now.

Shhhhh.

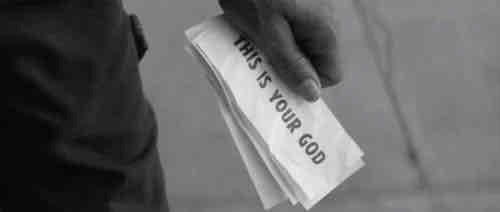

Don’t tell them that 3 pennies aren’t actually more than two quarters because there’s more of them.

Otherwise people will catch on that they are being grossly fleeced by an unfair and abhorrent system of generalized inequality.

Reap what you sow.