Americans have depleted their excess savings and are now depleting their credit lines as well. The percentage with delinquent credit card debt is approaching the peak at the end of the dotcom bubble.

Yeah, I can’t believe Biden caused the dot com bubble and now he’s causing global inflation.

Even here in Germany my cost of living is higher now, thanks to Biden.

Yes.

Just admit you didnt read the article. It didnt blame anyone for the dot com bubble or inflation on Biden.

I did read it.

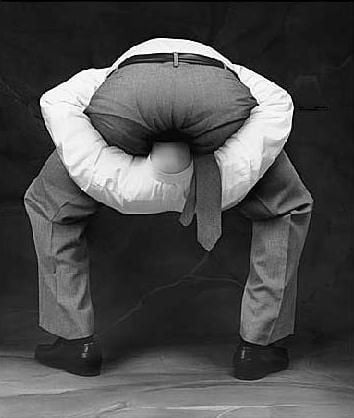

What’s the first image?

What is the thumbnail?

You judged a book by its cover.

An article by its first picture, but there is a reason why it’s been picked.

It was picked because it contradicts the BS coming out of the WH that things are great, nothing to sorry about. Which is one of the many reason hes bleeding support. He and his press secretary go on and on about how great things are, but we are experiencing the exact opposite in our lives. The blatant lies tell us they are not listening to our concerns and dont care.

Didn’t you say it wasn’t about Biden?

Its not about Biden, its about the condition of the economy, and its not as good as the lies being told

ELI5 what you’d do if president, with the exact same 2 houses of Congress and the same supreme court of 2024, to fix everything that is not great with our lives.

Also, check your non-housing and non-food expenses from 2018 vs today’s, and see if you’re spending way more on non essential fun things. Usually disposable income is a telling sign of how good things are.

“Citigroup has become the first big American bank to warn that the US has already tipped into a recession.”

A recession is commonly defined as “two consecutive quarters of decline in a country’s real (inflation-adjusted) gross domestic product (GDP)”.

https://www.bea.gov/data/gdp/gross-domestic-product

Q4 2023 - +3.4%

Q1 2024 (2nd) - +1.3%Next announcement is 6/27.

So, no, we aren’t in a recession YET. Even if the 2nd quarter is a decline, we’d need a decline in the 3rd quarter as well to officially call it.

Okay, but what you’re presenting here still shows growth in GDP in Q1 ‘24. It’s decelerated, but it’s still growth. It’s not a decline.

Correct, which is why I’m saying we aren’t in a recession YET.

Even if they announce a decline in the 2nd quarter on June 27th, we would still need a decline in the 3rd quarter to be a recession.

Positive growth is not a decline. The decline is in the 2nd derivative, not in the velocity. You need 2 consecutive Q of NEGATIVE numbers. Not decreasing positive numbers.

Correct, which is why we aren’t in a recession YET.

Even if the Q2 numbers go negative when they’re announced later this month, we STILL aren’t in a recession unless the Q3 numbers are also negative.

Recession has no real definition until after the fact.